Choosing The Right Lakes Location For Your Holiday Let

So, you’ve already decided to purchase a holiday rental in the Lake District, which is consistently rated as one...

Great news if you’ve been considering buying a holiday let. The threshold for paying the Stamp Duty Tax will remain at £500,000 for an extra three months from the original end of March 31st to June 30 2021.

Then from June 30th, the Stamp Duty threshold will not return to the original £125,000 but will sit at £250,000. This will allow more people to purchase a home without the worry of paying the tax upon completion.

Also known as Stamp Duty Land Tax (or SDLT), it is a tax that must be paid when buying a property in England or Northern Ireland. The amount that you pay depends on the purchase price of your property.

Read on to learn more about the stamp duty extension…

Stamp Duty or Stamp Duty Land Tax (SDLT) is a cost a buyer must pay when purchasing a residential property or a piece of land in England and Northern Ireland worth more than £125,000. The charge works on a tiered basis and is only applicable after the minimum threshold price is reached. This increases in relation to the value of the property thereafter.

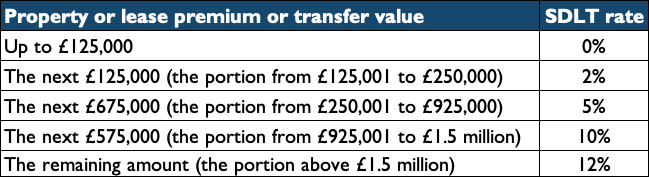

Normal rate of Stamp Duty

*Stamp Duty guide information from HMRC website prior to changes

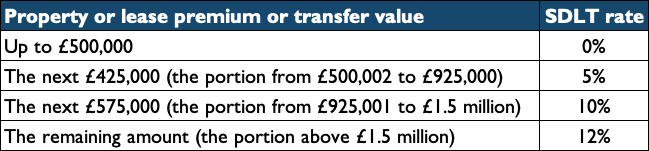

A Stamp Duty Holiday is a change to the threshold at which buyers pay tax on purchasing a residential property or piece of land. This change was announced by the UK Government and came into immediate effect on the 8th July 2020. It is an economic response to the COVID-19 pandemic.

The changes mean that the threshold at which buyers must start paying Stamp Duty on a property they purchase increases from £125,000 to up to £500,000. This change means that buyers now only start to pay tax on property above £500,000. It is designed to support the housing sector through the crisis.

*Stamp Duty guide information from HMRC website detailing reduced rates available until 30 June 2021

Are you thinking of buying a holiday home?

Use the HMRC Stamp Duty Land Tax calculator to find out how much tax you can expect to pay.

*Information from HMRC website (2021)

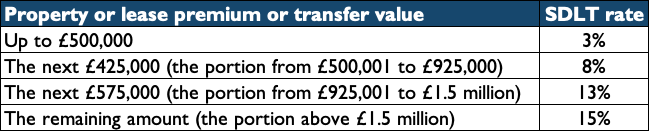

When you buy any property in addition to your main residence, be it a second home, a holiday home or a buy-to-let, there is an additional Stamp Duty charge known as Higher Rates on Additional Dwellings tax (HRAD). This starts at 3% and then rises in bands, climbing to 15% for the most expensive properties. Those purchasing a buy-to-let or second home will also benefit from the Stamp Duty changes and are eligible for the tax cut, but will still have to pay the extra 3% of HRAD charged under the previous rules.

The temporary Stamp Duty thresholds including Higher Rates on Additional Dwellings tax until 30th June 2021

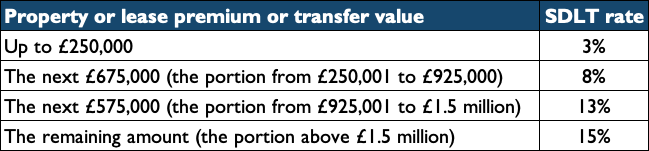

From 1 October 2021 the higher rates will then apply on top of the standard rates of SDLT.

Use the SDLT calculator to work out how much tax you’ll pay. View more about SDLT for additional dwellings here

The Stamp Duty holiday in England is applicable until the 30th June 2021. On 1st July 2021, the reduced rates shown in the above tables are expected to revert to the rates of SDLT that were in place prior to 8th July 2020.

The UK has become an increasingly popular place to holiday over recent years and a Visit Britain study shows that the spend on UK staycations during 2019 was over £24.7 billion – an increase of almost 3% on 2018.

2021 is set to look even brighter for UK holiday let owners as holidays abroad remain uncertain with Covid-19 creating ever-changing restrictions and travel corridors, meaning the consumer is perhaps less confident to holiday abroad and will choose to book a staycation instead.

One of the benefits of short-term letting instead of long-term letting is the potentially higher income that holiday lets can offer. Holiday lets benefit from flexible and often daily pricing, as opposed to long-term lets which typically adopt strict monthly pricing strategies.

If your holiday let is successful, this could result in a much higher income return than if you chose to long-term let.

With short-term lets, you and your family get to select which weeks which you can come and stay and enjoy your holiday home.

As furnished holiday lets (FHLs) are deemed as a business, holiday let owners can be eligible for a number of tax benefits that you wouldn’t be entitled to if you decided to long-term let.

The current tax relief that you can benefit from includes; Mortgage Interest tax relief, Business Rates relief, Capital Gains tax relief and more.

Our helpful and knowledgeable team of local Property Consultants are on-hand to offer any advice and guidance that you may need. The fact that you are choosing to buy a property in the Lake District, which is the number one location for UK holidays is, of course, an added bonus. (source: Visit Britain 2020).

Our team are local and know the area like the back of their hand. If you’re interested in a chat about how we can help, simply complete the form online here, email us at owners@lakelovers.co.uk, or ring us on 015394 32321.

Check out our properties for sale here

* At the time of publishing Lakelovers has taken all reasonable care to ensure that the information contained in this article is accurate. However, no warranty or representation is given that the information is complete or free from errors or inaccuracies. Generic information is contained within this article and each individual’s tax affairs are different, further advice should be sought from an accountant.